Disney reported that its parks, experiences, and products division had produced USD 32.3 billion in operating income over the past 12 months

California-based entertainment giant Walt Disney Company says it would nearly double capital expenditure for investment in its parks segment to roughly USD 60 billion over the next 10 years.

In a press statement, the Walt Disney Company says it will focus on investing in expanding and enhancing domestic and international parks and cruise line capacity.

Bob Iger

“We are incredibly mindful of the financial underpinning of the company, the need to continue to grow in terms of bottom line, the need to invest wisely so that we are increasing the returns on invested capital, and the need to maintain a balance sheet, for a variety of reasons. The company is able to absorb those costs and continue to grow the bottom line and look expansively at how we return value and capital to our shareholders,” says Bob Iger, CEO.

Disney says its parks have established themselves as a dependable source of revenue for Disney and have assisted in reducing losses in the Disney+ streaming business, which is predicted to turn profitable only next year. Iger has called the parks ‘a tremendous business’ for the international entertainment giant with headquarters in California.

Iger says that the firm intends to invest USD 17 billion in Florida over the next decade and is outlining long-term plans for additional features and attractions at the Disneyland Resort in Anaheim, California.

According to the statement, Disney reported that its parks, experiences, and products division had grown at a combined annual growth rate of 6 pc since fiscal 2017 and produced USD 32.3 billion in operating income over the past 12 months.

Disney says that periods of considerable investment, such as the advent of Cars Land at Disney California Adventure or Disney’s Hollywood Studios in Orlando, had boosted attendance.

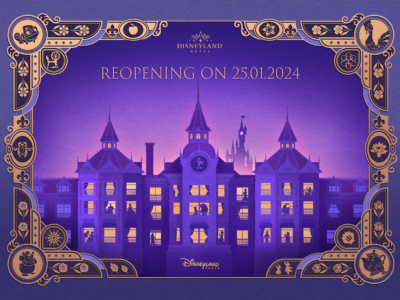

It says that new Frozen-themed lands will be launched in Hong Kong Disneyland, Walt Disney Studios Park in Paris and Tokyo Disney Resort, as well as a Zootopia-themed land at Shanghai Disney Resort. Disney says it is also looking to explore even more characters and franchises.

Josh D’Amaro

“We have a wealth of untapped stories to bring to life across our business. Frozen, one of the most successful and popular animated franchises of all time, could have a presence at the Disneyland Resort. Wakanda has yet to be brought to life. The world of Coco is just waiting to be explored. There’s a lot of storytelling opportunity,” says Disney Parks, Experiences and Products Chairman Josh D’Amaro.

Disney says its parks business is a key driver of value creation for the company, and FY23Q3 has come in part from strong performance at Disney’s international parks, particularly those in Asia. Shanghai Disney Resort and Hong Kong Disneyland, which have both shown meaningful growth coming out of the pandemic through Q3 FY23, have even further growth opportunities with the expansions set to open later this year.

The statement adds that over the next two years, Disney will nearly double the worldwide capacity of its cruise line, adding two ships in fiscal year 2025 and another in 2026, including a new homeport in Singapore beginning in 2025 to expand its reach further into the Asia-Pacific region.

According to Disney’s internal research, there is an addressable market of more than 700 million people with high Disney affinity it has yet to reach with its Parks.

“Throughout our history, we have created enormous growth by investing the right amount of capital into the right projects at the right moment. We are planning to turbocharge our growth yet again with a robust amount of strategic investment in this business,” said Iger.