PATA says that Asia will lead the recovery, with visitor arrivals from within the region reaching 564.0 million

International visitor arrivals (IVAs) to Asia Pacific are expected to increase from 619 million in 2024 to 762 million in 2026, with a recovery rate of 111.6 pc compared to the 2019 level. As many as 34 out of 39 destinations expected to recover to pre-pandemic levels.

These are the key findings of Asia Pacific Visitor Forecasts 2024-2026 report, released by Pacific Asia Travel Association (PATA), Asia’s largest tourism organisation.

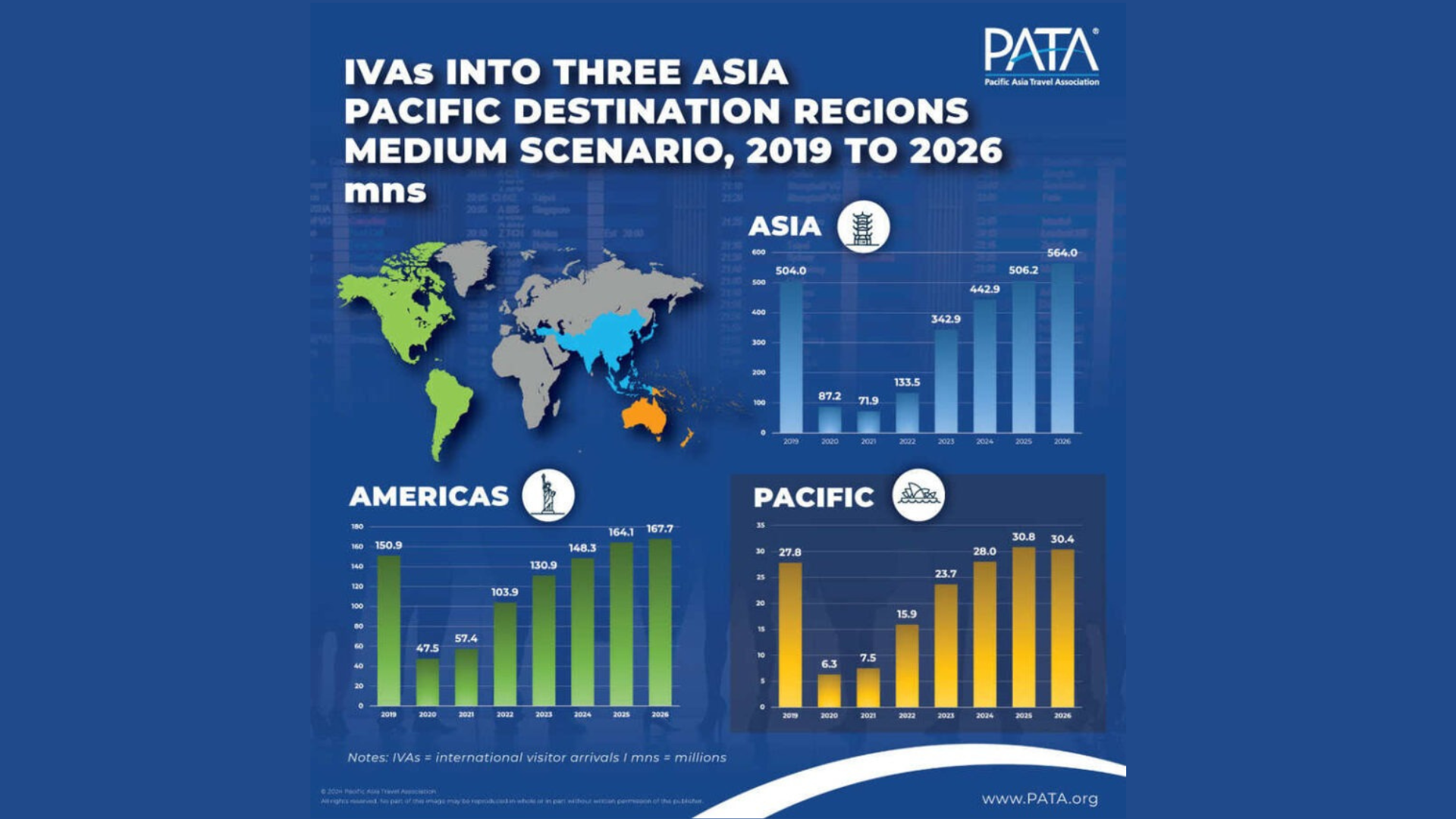

PATA says that Asia will lead the recovery, with visitor arrivals from within the region reaching 564.0 million. It will be followed by the Americas with 167.7 million and the Pacific with 30.4 million by 2026, highlighting the region’s resilience and growing potential as a travel destination.

According to the report, Japan and the Maldives top the list of destinations that will recover the fastest, with 34 out of the 39 destinations covered by the report expected to return to their pre-pandemic levels.

China, the US, the UK, and Australia are expected to maintain their leading positions as major source markets of IVAs to the Asia Pacific region, all of which are forecast to recover to pre-pandemic levels by 2024, fuelled by their economic growth potentials.

The report says that Japan is forecast to welcome 49.3 million visitors by 2026, which is 155 pc more than the 2019 number. The Maldives is expected to host 2.5 million visitors, indicating a 148 pc recovery rate to pre-pandemic levels. With this in mind, the visitor arrivals recoveries in the region call for appropriate destination management strategies, says PATA.

Noor Ahmad Hamid

“While most destinations within the Asia Pacific region are rebounding strongly and moving closer to pre-pandemic levels, this forecast highlights the significant changes as experienced by the individual destinations. Therefore, it is important to understand this trend which will impact the future growth for respective destinations as compared to the overall region,” says PATA CEO Noor Ahmad Hamid.

“The ramifications for destination marketing organisations (DMOs) to be more agile, flexible and robust to quick changes in the marketplace, especially output from the source market will play a crucial role on which destination will perform better than the other in the coming years. Destination marketeers and policy makers must understand that what they do in 2023, might no longer work from this year onwards, as the travel market shifts expeditiously while consumer buying power depends very much upon user-generated content (UGC).

In this regard, understanding the PATA forecast report, which takes into consideration various key factors such as economic indicators and travel capacity will be crucial,” he adds.