In 2021, the international passenger numbers jumped by over 11.5 pc to 524 million

In 2020, due to the outbreak of the Covid-19 pandemic in late 2019, as passenger traffic dropped by a record 60 pc to 1.88 billion passengers, the global aviation industry is believed to have lost USD 372 billion, its worst-ever performance, says the International Civil Aviation Organisation(ICAO), the United Nations body for global aviation industry.

The ICAO estimates that in 2021, though the pandemic continued to wreak havoc and many international borders still remained closed, there was a partial revival in air travel with the total number of passengers for the year estimated to be close to 2.3 billion, a smart recovery of 23 pc over the 2020 lows.

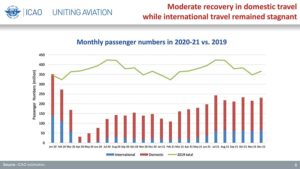

The ICAO says that so far the recovery has been very largely driven by domestic passengers rather than international travellers. It says that while in 2019, domestic passengers accounted for 59 pc of total 4.54 billion travellers, in 2020, the share of domestic passengers grew dramatically to 74 pc. It also says that in 2021, the share of domestic passengers grew even further, albeit marginally, to 77 pc of all passengers.

ICAO says that so far the recovery has been very largely driven by domestic passengers rather than international travellers (IO photos)

This signals at a very strong domestic aviation revival in most parts of the world, including here in India. The ICAO says that decline in domestic travellers’ numbers is much smaller than the international travellers. For instance, in Asia Pacific at the end of December, the total domestic seat capacity reduction in Asia Pacific was marginally more than 20 pc as compared to 2019. However, in the same region, the international seat capacity was still almost 75 pc lower in December 2021 than in December 2019, indicating that the international travel in the region, and to some extent, around the world was nowhere near the 2019 figures.

Source: ICAO estimates

However, not all is dark about international travel as there have been strong signs of increase in absolute numbers. In 2019, 1863 million passengers took international flights and in 2020, this number collapsed to a mere 470 million, largely due to strict travel restrictions and border closures in most parts of the world.

In 2021, the international passenger numbers jumped by over 11.5 pc to 524 million, even though large parts of the world, including China, the second largest aviation market, remained closed. The ICAO says that international travel was strongest in Europe with 281 million passengers. While it was still barely 33 pc of the pre-pandemic international in the region, international travel in Europe was in a much better shape than say in Asia Pacific, where it has continued to slide from a hefty 497 million in 2019, to 99 million the next year and further to 44 million in 2021. This was mainly because two of the largest markets, China and India, have remained closed for a large part of the period.

Ralph Hollister, Travel and Tourism Analyst, GlobalData

While China’s ban on international travel has continued, India has seen a number of Indians head to various destinations, notably the Maldives, the UAE and some parts of Europe. However, the numbers still remain a long way from the peaks seen in 2019, when close to 27 million Indians left for overseas travel. According to the DGCA, the number of Indian departures overseas collapsed to barely 7.29 million in 2020. Though the data for 2021 is not yet available, most experts believe that the performance would have significantly improved due to the reopening of some borders, with a large number of Indian tourists headed to neighbouring countries like Maldives, Sri Lanka as well as the United Arab Emirates.

Tour operators say that there has been a partial recovery in international travel. “Covid-19 has caused a significant loss in air connectivity. As a result of travel restrictions, unique city-pairs declined for the first time since the global financial crisis. In 2020, the number of unique city pairs was reduced by 30 pc. In 2021, unique city-pair connectivity is expected to partly recover as airlines expand their networks with the easing of travel restrictions in some regions. However, it will be 15 pc below 2019 levels,’’ Jyoti Mayal, president of Travel Agents Association of India (TAAI), one of the largest and oldest industry organisations in India, tells India Outbound.

Mayal’s opinion is backed by Ralph Hollister of GlobalData, a data collection and analysis firm. “GlobalData’s projections show a slight recovery for the Indian airline sector in 2021. Last year, total passenger airline revenue was at 54 pc of 2019 levels. However, this is an improvement from 2020, when revenue was at 24 pc of 2019 levels. From 2020 to 2021, total passenger airline revenue is expected to increase by 126 pc, year on year,’’ Hollister tells India Outbound.

Dual-speed recovery to continue in 2022

Despite the uncertainties imposed by Omicron variant and a record number of flight cancellations in December 2021, most experts believe that the global aviation is well set on its path to a dual-speed recovery, with domestic air travel to continue to recover at a much faster rate than the international traffic.

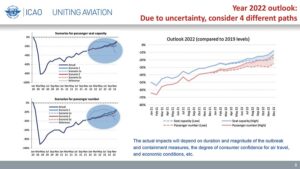

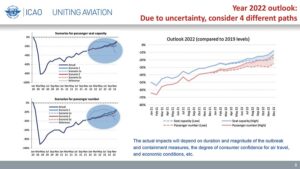

ICAO says that the damage caused by the pandemic to the global aviation industry will drastically reduce in 2022 and says that total seats offered by airlines in this year would be only 19-22 pc lower than the pre-pandemic capacity in 2019. This is a significant improvement over even 2021 when 40 pc fewer seats were offered by airlines as compared to 2019.

The ICAO estimates reflect the growth in passenger numbers also. While in 2021, 2,210 million fewer passengers travelled as compared to 2019, in 2022, the difference would be reduced to 1,134-1,367 million passengers, meaning that total air travellers in the year could be upwards of 3.3 billion.

Source: ICAO estimates

The dual speed of the recovery would be noticed even more sharply as ICAO estimates that the domestic air travel may be zeroing in to the 2019 levels. It says that seat capacity would be only 7-10 pc below 2019, but in the international segment, the seat capacity would still be significantly lower than 2022, ranging from 35-40 pc.

GlobalData also forecasts a dual-speed recovery. “Domestic routes are likely to see the biggest increases in business as domestic tourism is expected to recovery at a quicker rate in comparison to international tourism. Domestic tourism is expected to recover by 2022, in terms of trips taken, while outbound and inbound tourism is expected to recover by 2024. Leisure passengers using low-cost airlines are expected to drive recovery, with this passenger type purchasing the highest amount of seats prior, during, and after the pandemic,’’ Hollister says.

Source: ICAO estimates

The civil aviation ministry says that total domestic air traffic in the nine months from April 1 to December 31, 2021 was 11.1 million, a jump of 52 pc over the same period in 2020. However, it still remained a long-way off the pre-pandemic level as the numbers were 44 pc lower than in 2019. These numbers, however, do exceed comfortably the predictions made by the Centre for Asia Pacific Aviation (CAPA), a consultancy. Earlier in the year, CAPA had predicted that in the current financial year, ending March 31, 2022, Indian airlines could ferry up to 95 million passengers.

While the domestic travel recovery is well-set, the problem continues in the international segment, where the closed borders as well as restrictions of the Indian government itself are the biggest hurdles, rather than lack of demand.

TAAI’s Mayal says that the international travel, at least from India, can pick up much more rapidly than today if the government allowed regular flights to begin, after almost two years of grounding them. Today, India allows international flights only under a ‘bubble’ agreement with select countries. Though the number of bubbles has increased over the past year, they are still highly restrictive and have put a severe crunch on international airline capacity from India. Mayal says that the industry is ready for a real opening up.

“Yes, given the opportunity airlines would like to increase capacity to a large extent and also fly beyond air bubbles agreements. Closing borders with countries is not a solution as the virus does not need a boarding card or a commercial flight to travel. India has air bubble agreements with about 23 countries and with extensive vaccination and the use of the Air Suvidha portal on arrival further provides a safe passage to travel. The existing guidelines for international travellers arriving in India have been formulated taking a non-risk-based approach so overall in comparison to its neighbours, India sounds more promising and safer in terms of international flights. We need to let the aviation industry take its own decisions keeping safety protocols & cautiousness in mind,’’ advocates Mayal, blaming the current high air fares for international travel on the restricted supply imposed by the government. “The limited capacity also made travel very expensive. These past two years have indeed been very frustrating and the Ministry of Civil Aviation has not taken a conscious decision to connect with us to establish a better structure or policies to build a sustainable model,’’ she adds.

Source: ICAO estimates

Mayal goes on to say that as president of TAAI, she highly recommends restart of commercial flights operation and extension beyond air bubble agreements to expand the horizons of international travel. ‘‘We as an industry cannot shut down or close borders again because anyway that is not a full-proof method to stop the virus from spreading. Aligning the upcoming policies with the industry’s best of interests, more rapid PCR tests and the government to work in a more collaborative manner with TAAI. We definitely need an effective task force and think of India as one state and all countries as one nation to bring in one effective travel and tourism policy. Pandemic is global and we need to together work effectively in a collaborative manner to eradicate the virus and make the world a safer place because, like I said earlier building a wall for one state or country is not going to be a sustainable model. Ease of travel and business needs to be structured efficiently,’’ she says.

Full recovery of international travel some distance away

Jyoti Mayal, President, TAAI

Despite the positive outlook for the year ahead, none of the experts expect the air traffic, at least international, to come back to the pre-pandemic levels for another two years, with most forecasts zeroing in to 2024 as the year of return to normalcy. “We expect to see the full recovery of the Indian passenger airline sector by 2024,” says Hollister of GlobalData.

GlobalData predicts that in the current year, total passenger airline revenue is expected to be at 81 pc of 2019 levels, marking ongoing recovery. From 2021 to 2022, total passenger airline revenue is expected to increase by 51 pc, it adds.

Mayal says she and her industry colleagues are hoping that things don’t worsen even further before they get any better than now, blaming constantly changing rules and impressions of the state of the pandemic in the world. “With travel restrictions due to the pandemic and its subsequent waves, and now with the arrival of the new variant Omicron, flying out of the city or country for work has not seen the same revival as other travel segments. Aviation, business and long-haul travel will remain the slowest-recovering travel segments in 2022. Just when things started to look better and the aviation industry started to look forward other variants kicked in and things became stagnant again. We are back with confusion, lockdowns and fear once again reliving 2020. We can just pray and hope this upcoming year proves to be more fruitful and our lives and industry doesn’t suffer another irreparable set back or grinding to a halt,’’ says Mayal.

She adds that it was difficult to say anything right now as to when and how this pandemic will end and when the business could come back to pre-pandemic levels. ‘‘Looking at the current variant, I hope to believe that business will start in the third quarter of 2022 and come back in totality by 2024,’’ says Mayal.

New players prepare for take off

Even as bigger and established airlines, Indian and foreign alike, try to curtail operations in order to optimise seat capacity in the outbound sector, new players are set to start operations, heating up competition in the skies.

The summer of 2022 ought to be an interesting time to watch the Indian skies as a fresh series of dog fights is about to start as several new carriers take to skies at a time when finally outbound tourism from India is expected to take off again, after being grounded for well over two years thanks to the Covid-19 pandemic.

Leading the charge on the established carriers like Emirates, Lufthansa, Air India and increasingly Vistara, besides several other international carriers, is the old horse Jet Airways which is set to re-emerge from bankruptcy in a few months.

Hans Airways

The resuscitated airline is expected to take to the skies again very soon. In June 2021, it was bought by a consortium of Dubai-based Indian-origin businessman Murari Lal Jalan and British fund, Kalrock Capital. The new owners say they plan to induct 50 aircraft in three years and up to 100 in five years.

Though it is not clear whether the airline will retain its overseas flight rights as per the norms of the Indian civil aviation ministry, the airline is not likely to give up the valuable segment of the market without a battle.

Even as Jet Airways sorts out its status as an international carrier, the summer will see two start-up airlines, both belonging to Indian-origin entrepreneurs, flying on the lucrative and high volume United Kingdom to India.

Flypop

Start-up carrier Hans Airways will take delivery of its first aircraft, an Airbus A330-200, believed to have been in Air Europa fleet since 2008. For Hans Airways, the aircraft will be reconfigured in a two cabin layout, with 275 economy seats offering a 31- inch seat pitch, and 24 premium economy seats with a pitch of 56 inches.

Hans Airways plans to launch routes between the UK and India, operating flights from Birmingham to secondary Indian cities. The airline says that it has applied to the UK Civil Aviation Authority for its Air Operator’s Certificate and “is hopeful of obtaining the status in time to start revenue service this summer”.

The carrier has already started training its first set to pilots and cabin crew in Crawley. “We are delighted to have achieved this very important milestone in our two-year journey. Our scheduled operations centre on the Airbus A330, a popular and spacious long-haul widebody, excellent for cargo too, and we are grateful to everyone who has helped us to ratify this agreement at the start of the new year,” says Hans Airways’ CEO Satnam Saini.

Akasa Air

Hans Airways will join Flypop, owned by another Indian-origin businessman, Navdip Singh Judge. He also unveiled Flypop’s A330, with its distinctive livery of multi-coloured dots on the tailfin. The airline will bring two more of its fleet of aircraft into service for cargo duties and plans to launch passenger flights this summer “to meet the pent-up demand of the Indian diaspora communities living in the UK”.

Launch routes have yet to be confirmed, but the airline has outlined a number of target destinations for 2022, including Amritsar, Hyderabad, Goa, Kolkata, Ahmedabad, Kochi and Chandigarh, says Judge.

Besides these carriers, another new airline that has kept the Indian aviation market busy with buzz is Akasa Air, a startup airline backed by billionaire investor Rakesh Jhunjhunwalla. Formed barely a couple of months earlier, Akasa Air was aggressively snapping up aircraft at the Dubai Air Show in December 2021.

Jhunjhunwala has placed the airline in trusted old hands in Indian aviation, notably Vinay Dube, former CEO of Jet Airways, who has taken over as the CEO of Akasa Air and the airline also has former Indigo president Aditya Ghosh.

Akasa Air is expected to be targeting the low-cost carrier space in the country and hence could be a problem for struggling SpiceJet, GoAir as well as market leader Indigo.