Mordor Intelligence shows that the Middle East’s private and domestic aviation segments remained resilient during the pandemic and are continuing to display signs of growth

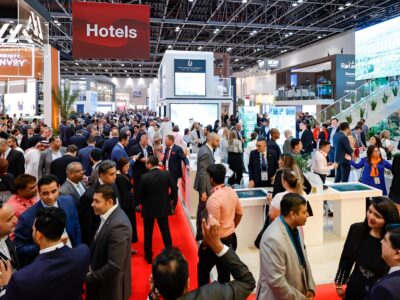

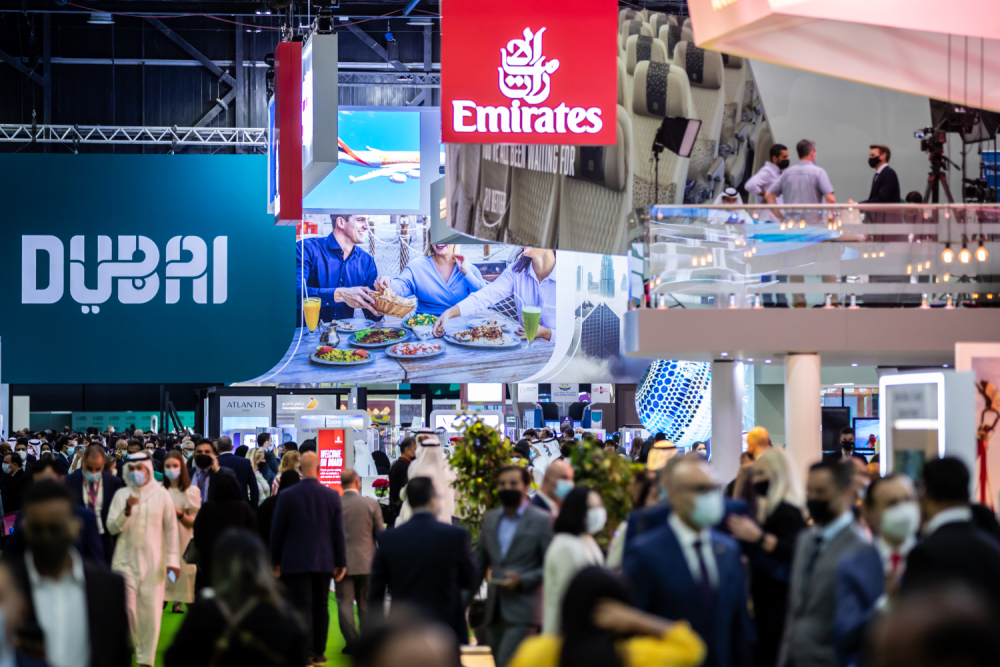

Less than a fortnight before the Arabian Travel Market gets underway in Dubai, latest data by research firm Mordor Intelligence, the Middle East’s aviation industry is expected to expand at a compound annual growth rate (CAGR) of more than 6 pc during the period 2022-27.

Although the recovery estimated for international passenger traffic is gradual, Mordor Intelligence shows that the Middle East’s private and domestic aviation segments remained resilient during the pandemic and are continuing to display signs of growth.

“The latest market analysis suggests that budget carriers such as Air Arabia Abu Dhabi and Wizz Air Abu Dhabi will drive demand for new narrow-body aircraft during the coming years. The Middle East’s aviation sector has also witnessed high demand for private travel during recent years, thanks to corporations and high-net-worth individuals (HNWIs) opting for business jet and helicopter journeys during the pandemic,” says Danielle Curtis, Exhibition Director ME – Arabian Travel Market.

“As such, the Middle East’s aviation sector will represent a major focus at ATM 2022, thanks to a dedicated session on the ATM Global Stage, plus a number of related events and forums throughout the event. We also look forward to exploring long-term opportunities related to the future of transport,” she adds.

On the second day of ATM 2022, a high-level panel discussion will address pandemic-related challenges faced by the industry. Moderated by John Strickland, Director of JLS Consulting, speakers including Tony Douglas, Group Chief Executive Officer of Etihad Aviation Group and Adel Abdullah Al Ali, Board Member and Group Chief Executive Officer of Air Arabia, will also share insights into opportunities and likely structural change within the aviation sector as its recovery continues.

Later the same day, another session, organised in conjunction with the Global Travel & Tourism Resilience Council will explore new and emerging modes of transport – such as hyperloop systems, driverless vehicles, next-generation aircraft and space travel. Moderated by Sarah Hedley Hymers, Editorial Director in the Middle East for Connecting Travel, speakers will include Kuljit Ghata-Aura, President – Middle East, Turkey & Africa at Boeing; Kata Cserep, Vice President and Global Managing Director – Aviation at ICF; and Karime Makhlouf, Chief Commercial Officer at Royal Jordanian.

“Market leaders such as Emirates, Etihad, Saudia, Qatar Airways and others also reflect a positive longer-term trajectory for the sector,” adds Curtis.

In October 2021, Etihad announced it had raised USD 1.2 billion as part of the first regional sustainability-linked loan (SSL) to include environmental, social and governance (ESG) metrics. The deal’s terms were tied to targets to reduce carbon emissions, increase corporate governance and promote female participation.

In November 2021, Emirates announced a major retrofit programme which will see 52 of its existing A380 aircraft fitted with Premium Economy cabins and other enhancements, signalling its optimism for industry recovery and the return of travel demand. The following month, Emirates received delivery of its 123rd Airbus A380 superjumbo jet, despite the outbreak of the Omicron variant.

More recently in January 2022, Boeing revealed that it had won a major order from Qatar Airways worth USD 34 billion at list prices. The order includes the purchase of 25 Boeing 737 Max 10 jets along with options to buy 25 more. Qatar’s national airline also signed an order for 34 Boeing 777X models, with options to buy 16 more.

Meanwhile in the kingdom, Saudi Arabian Airlines, Saudia, is reported to be mulling an order of more than 100 aircraft from either Airbus or Boeing, according to Mordor Intelligence. The carrier aims to grow its fleet to 250 aircraft by 2030.